June 5, 2024

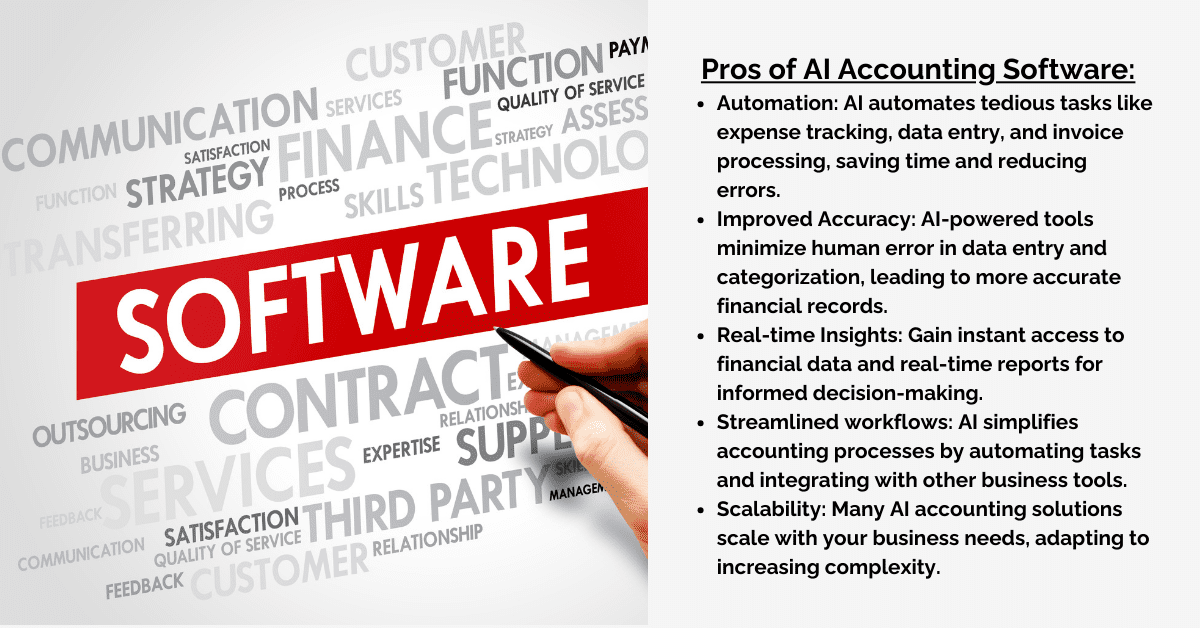

Gone are the days of wading through mountains of receipts and spreadsheets. Artificial intelligence (AI) is revolutionizing the accounting industry, offering software solutions that automate tasks, streamline processes, and empower businesses with real-time financial insights. But with a plethora of AI accounting software options available, selecting the perfect fit can feel overwhelming.

With a growing number of AI accounting solutions on the market, selecting the perfect fit for your business can be daunting. This comprehensive guide explores the best AI accounting software options available in 2024, equipping you with the knowledge to make an informed choice.

AI accounting software utilizes machine learning algorithms to automate various accounting tasks, including –

When selecting an AI accounting solution, consider these crucial features –

Traditional accounting software, while functional, often requires manual data entry and reconciliation, leading to errors and inefficiencies. AI accounting software tackles these challenges head-on by leveraging machine learning algorithms. These algorithms automate tasks like :

With a diverse range of AI accounting software options available, choosing the right one requires careful consideration. Here are some key factors to ponder –

Beyond these factors, conducting thorough research and exploring free trials offered by vendors can provide valuable insights before making a final selection.

The world of accounting is undergoing a revolution with the integration of Artificial Intelligence (AI). AI accounting tools automate tedious tasks, improve accuracy, and provide valuable financial insights. Here’s a breakdown of 10 of the best AI accounting software options in 2024 –

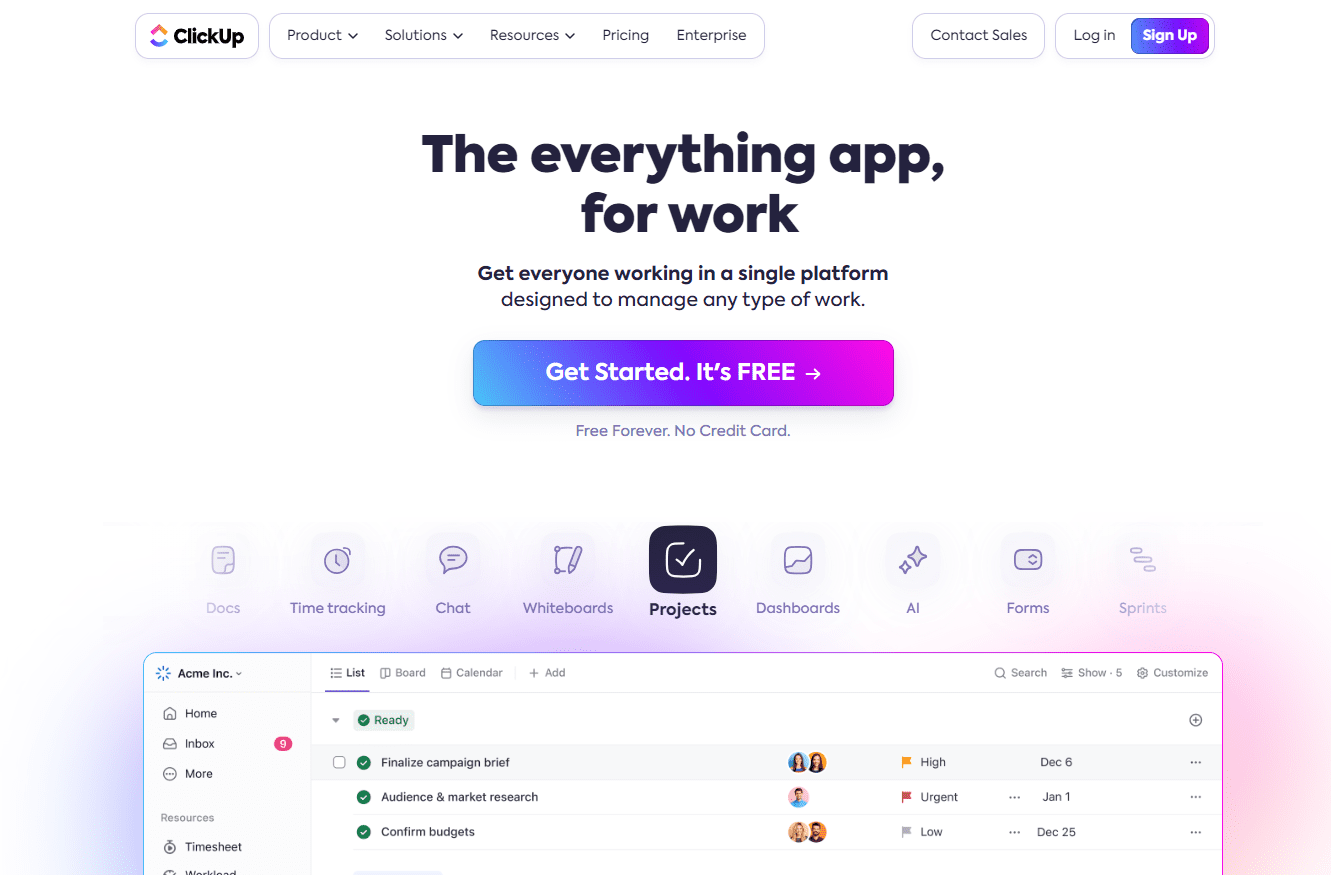

ClickUp is a project management platform with built -in accounting features. While not a dedicated accounting software, its AI capabilities automate tasks like expense tracking and receipt categorization.

Best Features –

Limitations –

Pricing –

Free plan available, with paid plans starting at $5 per user/month.

Ratings and Reviews –

ClickUp is praised for its user -friendly interface and robust project management features. However, some users report limitations for in -depth accounting tasks.

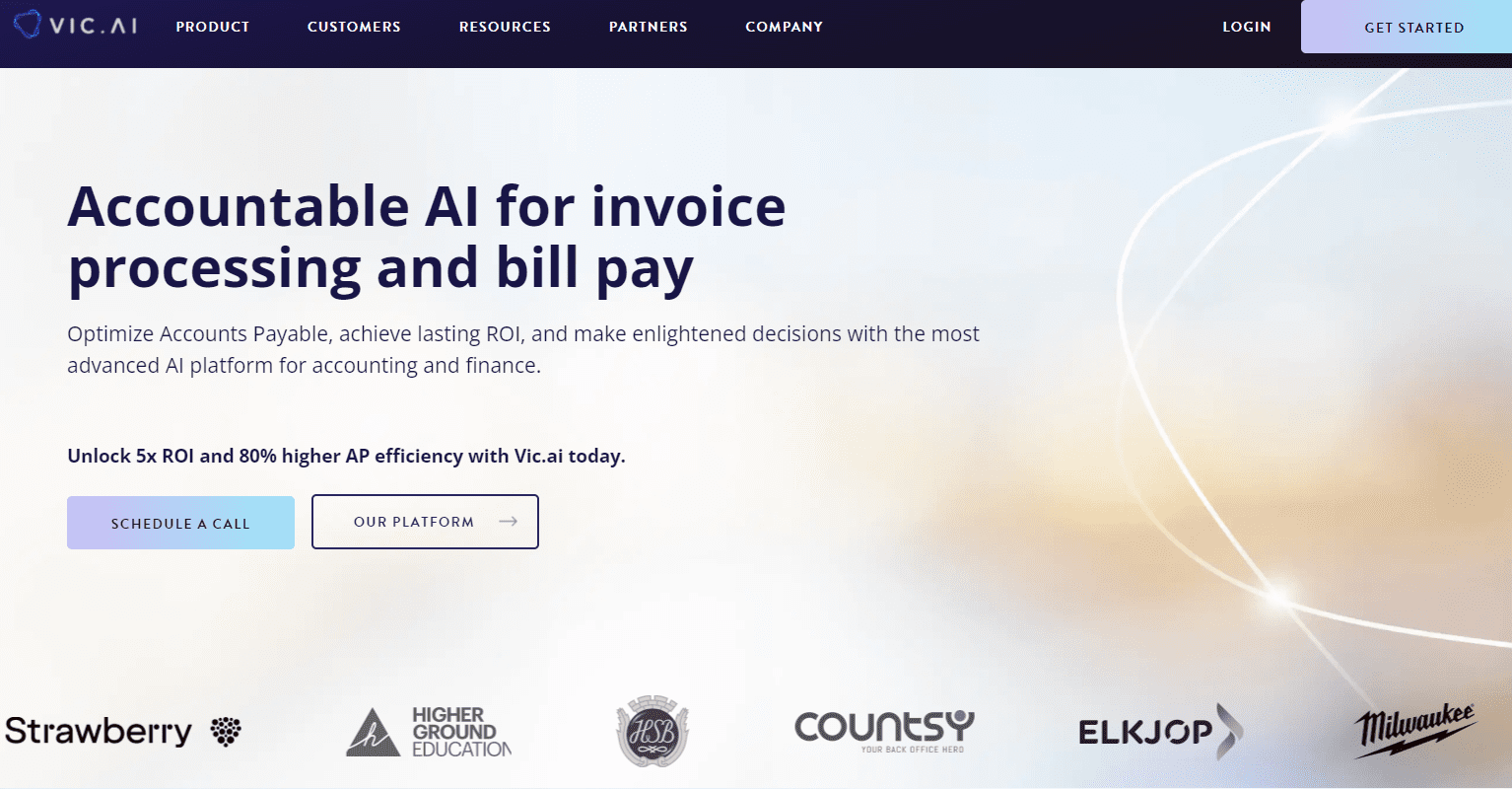

Vic.ai focuses on automating accounts payable (AP) tasks. It uses AI to extract data from invoices, streamline approvals, and eliminate manual data entry.

Best Features –

Limitations –

Pricing –

Custom pricing based on company size and invoice volume.

Ratings and Reviews –

Vic.ai is known for its exceptional accuracy and time -saving capabilities in AP automation. Users recommend it for businesses with high invoice volume.

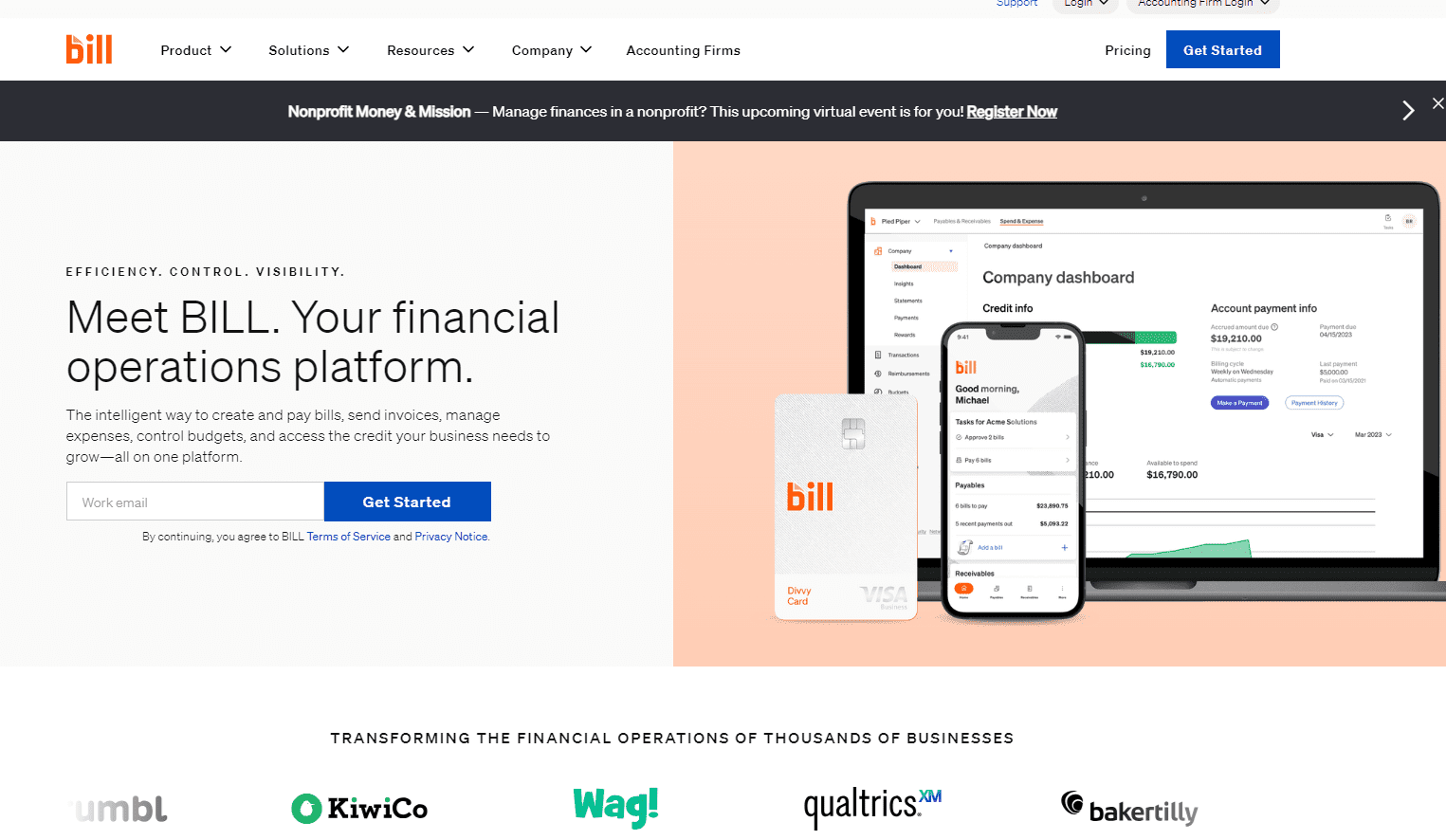

Bill.com is a cloud -based platform offering accounts payable (AP) and accounts receivable (AR) automation. Its AI features streamline workflows and reduce errors.

Best Features –

Limitations –

Pricing –

Starts at $39 per month for basic features, with additional costs for advanced functionalities.

Ratings and Reviews –

Bill.com is popular for its user -friendly interface and efficient AP/AR automation. However, some users find the pricing less competitive for smaller businesses.

Indy is an AI -powered bookkeeping solution designed for freelancers and entrepreneurs. It automates bookkeeping tasks, categorizes transactions, and generates financial reports.

Best Features –

Limitations –

Pricing –

Free plan with basic features, paid plans starting at $9.95 per month with expanded functionality.

Ratings and Reviews –

Indy is a good option for freelancers and solopreneurs seeking a user -friendly AI bookkeeping solution. However, its features may be insufficient for complex business needs.

Zeni is an AI -powered financial management platform designed for small and medium businesses (SMBs). It offers expense tracking, budgeting, and real -time financial insights.

Best Features –

Limitations –

Pricing –

Custom pricing based on company size and features needed.

Ratings and Reviews –

Zeni is praised for its intuitive interface, AI -powered expense tracking, and budgeting functionalities. However, some users recommend additional software for extensive accounting tasks.

Docyt is an AI -powered document processing platform that integrates with popular accounting software. It automates data extraction from invoices, receipts, and other financial documents.

Best Features –

Limitations –

Pricing –

Custom pricing based on usage and features needed.

Ratings and Reviews –

Docyt is valued for its accuracy and time -saving capabilities in document processing. Users recommend it for businesses dealing with high volumes of financial documents.

Gridlex is a virtual bookkeeping assistant powered by AI. It automates bookkeeping tasks, reconciles accounts, and generates financial reports.

Best Features –

Limitations –

Pricing –

Custom pricing based on company size and transaction volume.

Ratings and Reviews –

Gridlex is known for its automation capabilities and user -friendly interface. However, some users suggest it might not be the most cost -effective option for smaller businesses.

Booke is an AI -powered bookkeeping solution designed for startups and growing businesses. It automates bookkeeping, provides financial insights, and offers tax preparation assistance.

Best Features –

Limitations –

Pricing –

Starts at $199 per month with varying tiers based on features and support.

Ratings and Reviews –

Booke is a good option for startups and growing businesses seeking an AI -powered bookkeeping solution with tax assistance. However, its features and pricing might not be ideal for established businesses with extensive accounting requirements.

Blue Dot is an AI -powered accounting platform offering automated bookkeeping, bill pay, and financial reporting. It caters to small and medium -sized businesses (SMBs).

Best Features –

Limitations –

Pricing –

Custom pricing based on company size and features needed.

Ratings and Reviews –

Blue Dot is valued for its user -friendly interface, automation features, and integration capabilities. However, some users suggest exploring pricing options for the best value depending on business needs.

Truewind is an AI -driven financial management platform designed for small businesses and startups. It provides bookkeeping, budgeting, and financial forecasting functionalities.

Best Features –

Limitations –

Pricing –

Custom pricing based on company size and features needed.

Ratings and Reviews –

Truewind is praised for its user -friendly interface, AI -powered functionalities, and expert support. However, some businesses might require a more robust accounting solution for complex needs.

FINSYNC is a cloud -based accounting platform designed for small and medium -sized businesses (SMBs) that incorporates AI functionalities to enhance various accounting tasks. It boasts a comprehensive suite of features aiming to eliminate the need for multiple back -office applications.

Best Features –

Limitations –

Pricing –

FINSYNC offers tiered pricing plans based on the features you need. Information readily available on their website suggests plans start around $30 per month for basic features, with additional costs for functionalities like payroll or project tracking.

Ratings and Reviews –

Limited user reviews are available online. However, FINSYNC emphasizes its commitment to customer service, providing free onboarding and one hour of expert assistance per month.

AI is transforming the accounting landscape, empowering businesses with intelligent tools that automate tasks, streamline processes, and unlock valuable financial insights. By embracing AI accounting software, businesses can gain a competitive edge, improve financial health, and free up valuable resources to focus on core growth strategies.

So, are you ready to experience the power of AI in your accounting? With the information provided and further research, you can confidently select the perfect AI accounting software solution to propel your business towards financial success.

@2023-2024-All Rights Reserved-JustAiTrends.com